Whole life insurance dividends are a payment made to policyholders on a regular basis, typically quarterly or semi-annually. The dividend is determined by the company's actuarial value and how much premiums have been paid over the life of the policy. Policyholders can use this information to calculate their expected dividend payout.

There are a few things to keep in mind when checking Whole Life Insurance Dividend Rates:

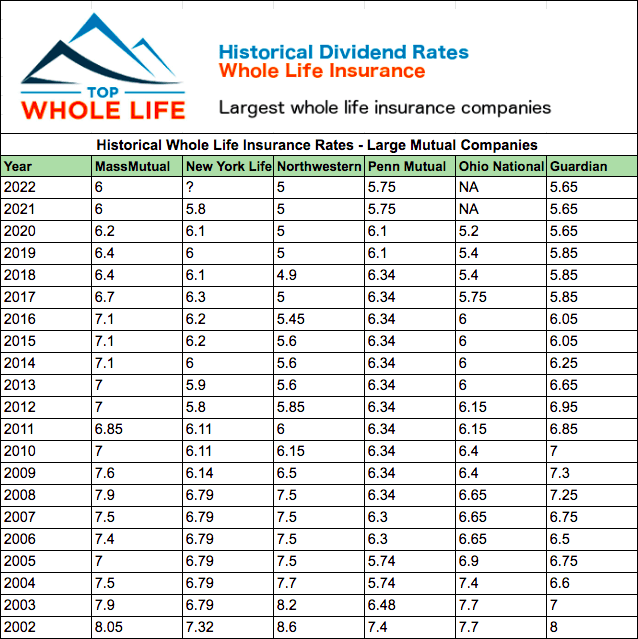

1. Premiums paid over the life of the policy affect the dividend payout. You can also check out whole life insurance dividend rate history online.

2. The company's actuarial value affects how much money is paid out in dividends.

3. Dividends are typically paid out on a quarterly or semi-annual basis, based on how much premiums were paid over the course of the policy's life.

If you're like most people, you're probably not checking your whole life insurance dividend rates on a regular basis. But it's important to do so if you want to stay secure in your policy. Here's why:

Your life insurance company will pay out a monthly dividend based on the actuarial value of your policy. The higher the actuarial value, the higher the dividend. If you don't check your dividend rate regularly, you could end up getting less money than you expected each month.

There are several ways to check your life insurance dividend rates. You can do it online or through an agent or broker. You can also compare different policies side by side to see which offers the best terms and payout rates.

By doing this, you can ensure that you're maximizing the potential of your policy and reducing the risk of losing everything if something happens to you while it's still in force.